While there are potential benefits expected with the introduction of MSM REITs, the long-term impact would have to be seen on the investors and the FOP business model.

As of September 2014, India approved creation of real estate investment trusts in the country. Real Estate Investment Trusts (REITs) can invest in real estate assets located in India, either directly or through holding companies and/ or special purpose vehicles (SPVs).

As of March 31, 2023, 5 REITs are registered with SEBI, of which three REITs have issued units which are listed on the recognized stock exchange. These are Embassy, Mindspace and Brookfield. They invest in big companies who take up office space and pay rent.

Although there is immense potential in real estate investment, one of the reasons for lesser number of REITs may be attributed to the requirement of minimum asset size of INR 500 crore and minimum offer size of INR 250 crore as envisaged in the REIT Regulations.

Fractional Ownership Platforms (FOPs)

In the last few years, India has witnessed an emergence of web-based platforms that provide investors an opportunity to invest in real estate assets, in exchange for fractional ownership in these real estate assets. Usually, the investors are required to invest on these platforms, popularly known as, FOPs. The strategy generally adopted by these FOPs is that the investors subscribe to the securities of a SPV established by the FOPs, which in turn purchases the actual real estate asset. Through this approach, the cost of acquisition of any identified real estate is split among several investors. It has been seen that these FOPs do not register themselves as real estate agents under RERA, even though they act as real estate agents or property managers.

SEBI Consultation Paper – Micro, Small and Medium (MSM) REITs

In May 2023, SEBI had floated a consultation paper for regulating the FOPs. SEBI has suggested that there is a need to govern the FOPs as the varying nature of structures adopted by the FOPs raise concerns regarding adequate protection to the investors and potential violation of the norms relating to Companies Act, 2013, Prevention of Money Laundering Act, 2022 and other laws.

SEBI intends to label these FOPs as MSM REITs. Under the proposed MSM REITs regulations, SEBI has indicated the MSM REIT be set up as a trust under the Indian Trusts Act, 1882. Further, similar to the existing REITs, MSM REITs shall have parties such as trustee, sponsor and investment manager.

While the criteria for a sponsor of a MSM REITs is similar to that of existing REITs, manager of MSM REIT requires a minimum net worth of INR 20 crore vs INR 100 crore required by a manager of an existing REIT.

The consultation paper proposes mandatory unitholding of 15% for 3 years (from the date of the listing of the units of the MSM REITs) by the sponsor of MSM REITs. This will ensure that the party establishing the MSM REIT will have skin in the game – resulting in comfort to the investors.

The minimum asset size to be acquired by such MSM REITs is INR 25 crores (which is far less as compared to the minimum asset size of INR 500 crores applicable to existing REITs).

The MSM REIT will be required to hold 100% equity share capital in all the SPVs, which is much stricter when compared to 26% threshold for existing REITs.

The minimum number of investors in case of MSM REITs is proposed to be 20 which is significantly less than 200 investors required in case of existing REITs. Under the MSM REITs, the minimum ticket price is proposed at INR 10 Lakhs (as compared to INR 1 Lakh in case of existing REITs).

MSM REITs would not be allowed to raise debt whereas REITs have historically been allowed to raise external debt.

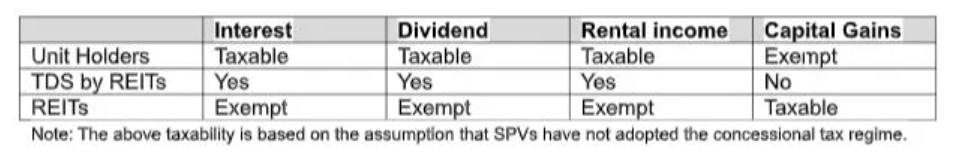

SEBI in its consultation paper has indicated that such MSM REITs shall be eligible for the same taxation framework as those applicable to the existing REITs, as MSM REITs will qualify as business trusts. The table below depicts the taxability of interest, capital gains, dividend and rental income for the REIT and its’ unit holders:

With respect to repayment of debt by REITs, typically, REITs lend to SPVs and SPVs may repay this loan with interest (surplus). REIT will then distribute this surplus to the unit holders. This surplus (considered as repayment of debt) was earlier not being subject to tax. Effective 1 April 2023, the repayment of debt will be taxable as income from other sources as per a prescribed formula in the hands of the unit holders.

Separately, in a recent board meeting held on 25 November 2023, SEBI has approved amendments to REIT Regulations in order to create a regulatory framework for MSM REITs. The SEBI Board minutes also indicate that the minimum asset size to be acquired by the MSM REITs shall be INR 50 crore instead of INR 25 crore (as suggested in the consultation paper). The revised REIT Regulations are awaited.

The introduction of MSM REITs should have a positive impact on the FOPs. Listing of FOPs shall provide liquidity event/ exit opportunity to investors at fair value along with the requisite investor protection norms. Also, the eligibility criteria for sponsors and managers should provide the necessary financial stability to the structures.

While there are potential benefits expected with the introduction of MSM REITs, the long-term impact would have to be seen on the investors and the FOP business model.

Credits: Financial Express